🚀 Introduction: When the Market Makes No Sense

The crypto market often puts traders in challenging situations—particularly during aggressive price surges that seem disconnected from fundamentals. This guide explores:

- Why shorting in an uptrend can be a disaster

- How to stay calm during sudden price pumps

- Tactical responses to liquidation threats

- Smart usage of averaging and hedging

Understanding these principles can help you survive—and even thrive—during unpredictable market swings.

❌ The Perils of Shorting During an Uptrend

🎯 Don’t Short “By Feel”—Wait for Trend Confirmation

Shorting based on a gut feeling can be deadly. A coin like AERGO can continue pumping despite low inflows or weak fundamentals. This often leads to forced liquidations, not from your shorts—but from mass long closures!

✅ Golden rule: Never short until you see a clear trend break. Until then—observe, don’t act.

🤯 When Charts Go Crazy: Recognizing Market “Nonsense”

Ever looked at a chart and thought, “This defies logic”?

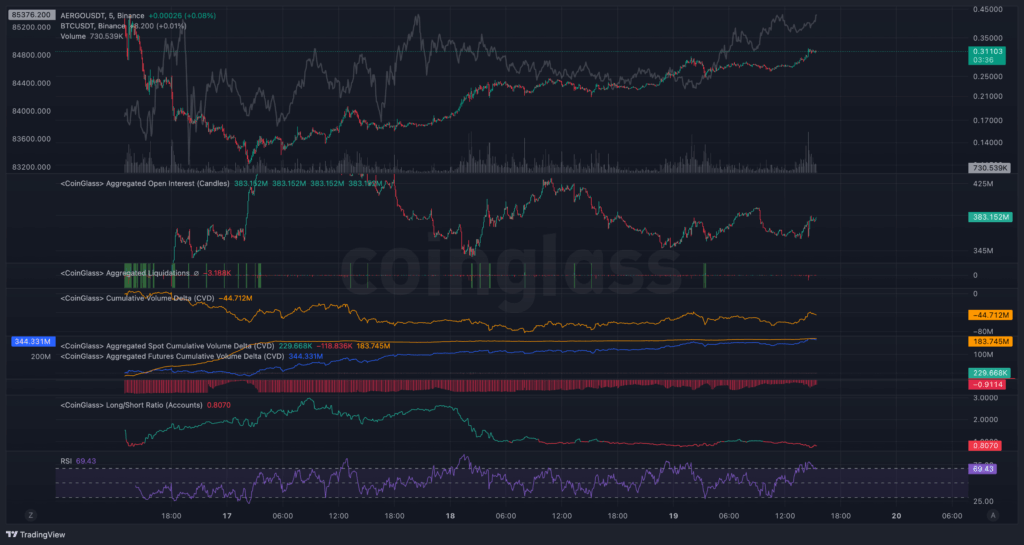

- Price climbs while funding stays flat or negative

- Volume disappears, but the price moonshots

📸 Pro tip: Screenshot and ask in your trading community—“What’s happening here?” Don’t trade confusion; investigate it.

🧠 Position Management: Averaging, Hedging & Exit Tactics

⚠️ When NOT to Average Down

Averaging can be deadly if liquidation is close (<50% margin left). Doing this in an uptrend means you’re feeding a losing position.

💣 Key takeaway: Averaging in a pump can wipe your account. Know your limits.

🛡 When to Hedge (and When Not To)

Hedging can protect your capital—but only if:

- You place a strict stop-loss

- You’re not just “throwing it on” during a panic

🙅♂️ Hedging directly into a pump without strategy = false security.

📌 Better move? Reduce or exit your position entirely instead of doubling down under stress.

🔓 4 Smart Reactions to Liquidation Threats

- Close part—or all—of the position.

- Move stop-loss to breakeven.

- Hedge at resistance (only with a hard stop).

- Exit temporarily and watch the chart.

📈 Trend or Range? Know What You’re Trading

🔍 Where to Spot Trend Confirmation

A true trend break is visible on all timeframes—from 15m up to daily. When a sideways chop turns into a sharp breakdown, it’s your short signal.

🤖 Don’t Trust Indicators Blindly

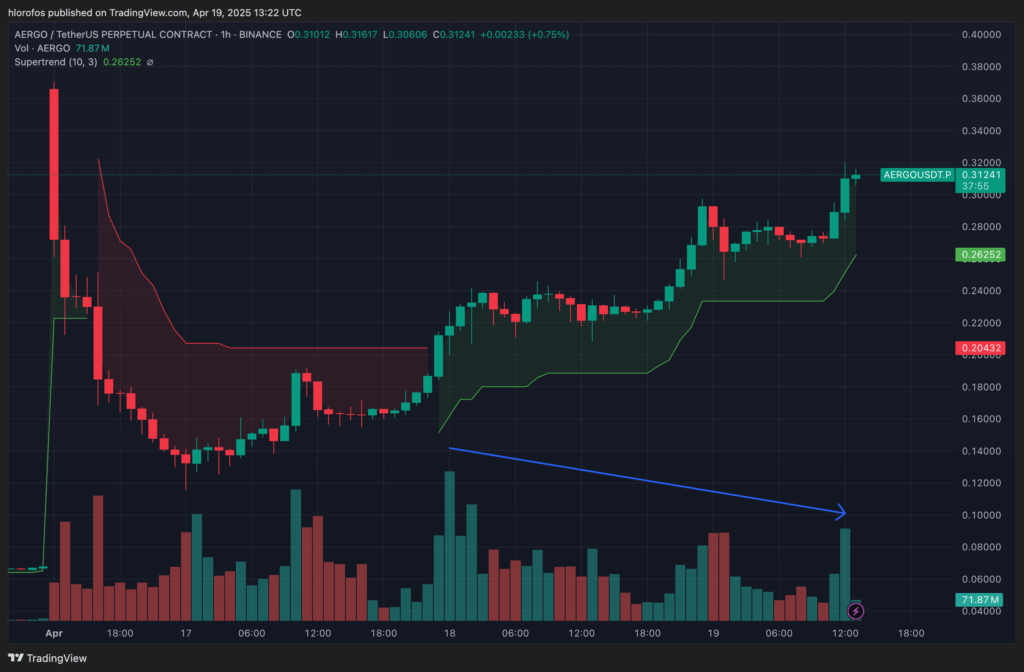

Indicators like SuperTrend may signal “Buy” even when the asset is overheating.

👉 Example: AERGO showed bullish SuperTrend signals while metrics clearly showed exhaustion.

💡 Price action + volume > indicators.

📝 Building a Winning Watchlist & Entry Strategy

📊 What Belongs on Your Watchlist?

Curate your list with coins that:

- Had recent pumps

- Show unusual volatility

- Appear in screeners (e.g., AVAI, AERGO)

Constantly recheck the list for bounce-back setups or reversal signs.

🎯 Ideal Entry Zones for Shorts

Look to short when:

- Price bounces after a dump, not at the top.

- It hits known resistance levels.

- Money exits during sideways movement, yet price fails to rise.

📍 Example: AERGO post-pump + weak funding + flat spot = textbook short after confirmation (!!!).

🧘♂️ Mastering Stress: Psychology of Trading Mistakes

😱 Common Emotional Errors

- Averaging down and hoping for a bounce

- Refusing to close during liquidation threats

- Panic trades from your phone (wrong order types, fat fingers)

🧘♀️ Mental Framework for Calm Execution

- Always trade from a PC

- Accept mistakes—they’re your tuition fee

- Predefine your max loss before entering

🧘♂️ Mental reset tip: When under pressure, close the terminal, walk away, and return in 15 minutes. Emotion kills clarity.

📌 Key Takeaways: Discipline > Prediction

- ❌ Don’t short in an uptrend. Wait for breakdowns.

- 🚫 Avoid averaging when close to liquidation.

- 🛡 Hedge only with a plan and stop-loss.

- 📋 Maintain and rotate your watchlist for the best entries.

- 🧠 Stay focused—emotions are the enemy of strategy.

💬 “Panic is the enemy of the trader. Success lies in system, discipline, and respect for risk.”